Deployed a Record $14.6 Billion of Capital in 2024, Including $8.9 Billion to Acquisitions

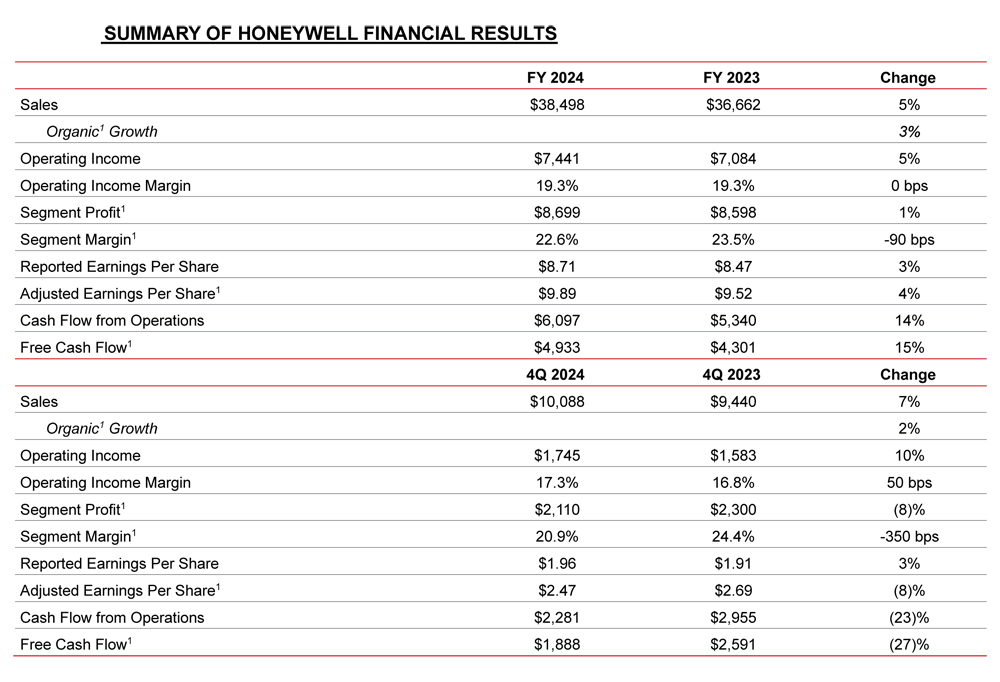

Honeywell (NASDAQ: HON) reported strong fourth-quarter results, with sales reaching $10.1 billion, a 7% year-over-year increase, and an organic sales growth of 2%. Earnings per share (EPS) for the quarter were $1.96, while adjusted EPS stood at $2.47, exceeding previous guidance. The full-year operating cash flow was $6.1 billion, and free cash flow was $4.9 billion, both at the high end of previous guidance.

The company announced it deployed a record $14.6 billion in capital during 2024, including $8.9 billion for acquisitions. For 2025, Honeywell expects adjusted EPS to be in the range of $10.10 to $10.50, reflecting a 2% to 6% increase.

Honeywell’s Board of Directors completed a comprehensive portfolio review and decided to separate its Automation and Aerospace divisions into three independent, publicly listed companies by the second half of 2026. This move aims to unlock significant shareholder value and allow each company to pursue tailored growth strategies.

Chairman and CEO Vimal Kapur stated, “We delivered a strong end to a successful year, exceeding the high end of our guidance for fourth-quarter sales and adjusted earnings per share. Our revitalized portfolio optimization strategy, established history of operational excellence, and robust installed base will unlock further value creation for our shareholders, customers, and employees.”

In 2024, Honeywell saw an 11% growth in its backlog, reaching a record $35.3 billion. The company reported that its defense and space, as well as building solutions segments, achieved double-digit organic sales growth. However, operating cash flow and free cash flow saw declines of 23% and 27% respectively.

As part of the strategic agreement with Bombardier announced in the fourth quarter, Honeywell will provide advanced technology for Bombardier aircraft in avionics, propulsion, and satellite communications, estimated to bring $17 billion in value over its life.

Honeywell’s outlook for 2025 includes sales of $39.6 billion to $40.6 billion, with organic sales growth between 2% and 5%. The company expects operating cash flow of $6.7 billion to $7.1 billion and free cash flow of $5.4 billion to $5.8 billion. The separation of Automation and Aerospace businesses is set to provide three industry-leading companies, each with distinct strategies and growth drivers.

![[기획] 머스크의 2026년 전망.. “2026 AGI의 승부처, 반도체 칩이 아니라 ‘태양’에 있다” [기획] 머스크의 2026년 전망.. “2026 AGI의 승부처, 반도체 칩이 아니라 ‘태양’에 있다”](https://icnweb.kr/wp-content/uploads/2026/01/moonshots-with-peter-and-elon-musk-zoom-1024x591.png)

![[분석] 엔비디아 블랙웰, 2026년 ‘1.3조 달러’ AI 인프라 시장의 독점적 지배자 부상 [분석] 엔비디아 블랙웰, 2026년 ‘1.3조 달러’ AI 인프라 시장의 독점적 지배자 부상](https://icnweb.kr/wp-content/uploads/2026/01/NVIDIA-CEO-GTC-blackwell-900web.png)

![[마켓] 엔비디아, 연 매출 1,000억 달러 시대 개막… AI 반도체 점유율 50% 육박 [마켓] 엔비디아, 연 매출 1,000억 달러 시대 개막… AI 반도체 점유율 50% 육박](https://icnweb.kr/wp-content/uploads/2026/01/Nvidia-bluefield-4-ces2026-1024web.png)

![[기자칼럼] 클라우드를 넘어 현장으로… 엣지·피지컬·온디바이스 AI, ‘산업 지능화’의 3대 축으로 부상 [기자칼럼] 클라우드를 넘어 현장으로… 엣지·피지컬·온디바이스 AI, ‘산업 지능화’의 3대 축으로 부상](https://icnweb.kr/wp-content/uploads/2026/01/perplexity-image-Edge-AI-web.png)

![[그래프] 국회의원 선거 결과 정당별 의석수 (19대-22대) 대한민국 국회의원 선거 결과(정당별 의석 수)](https://icnweb.kr/wp-content/uploads/2025/04/main-image-vote-flo-web-2-324x160.jpg)