The semiconductor shortage and the COVID-19 pandemic disrupted global original equipment manufacturers (OEMs)’ production in 2021, but the top 10 OEMs increased their chip spending by 25.2% and accounted for 42.1% of the total market, according to preliminary results by Gartner, Inc.

“Semiconductor vendors shipped more chips in 2021, but the OEMs’ demand was far stronger than the vendors’ production capacity,” said Masatsune Yamaji, research director at Gartner.

The semiconductor shortage prevented OEMs from increasing production not just of vehicles but also various electronic equipment types, including smartphones and video game consoles. However, the chip shortage significantly increased selling prices, which meant OEMs spent much more on semiconductor procurement in 2021 than in prior years.

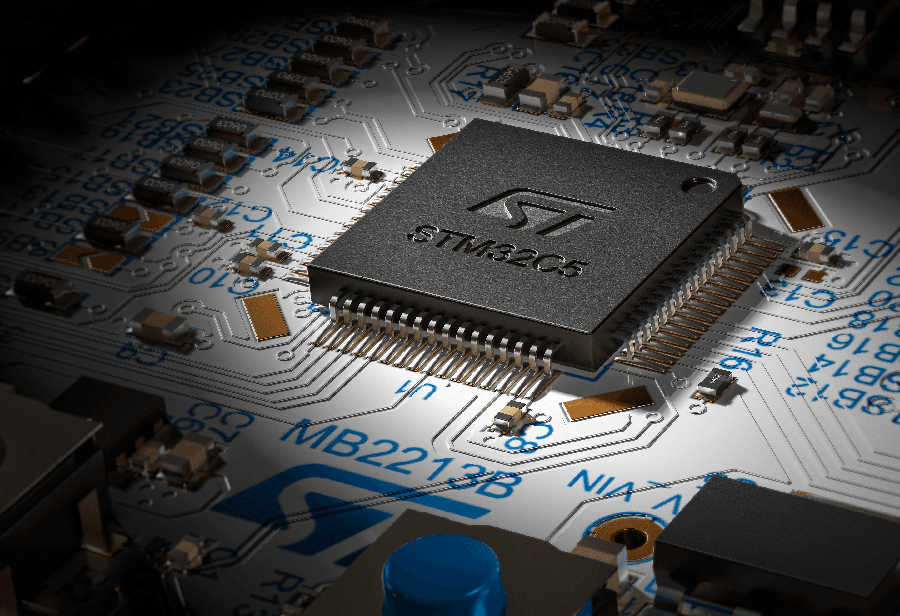

The average selling prices (ASPs) of semiconductor chips, such as microcontroller units, general-purpose logic integrated circuits (ICs), and a wide variety of application-specific semiconductors, increased by 15% or more in 2021. “The semiconductor shortage also accelerated OEMs’ double booking and panic buying, causing a huge spike in their semiconductor spending,” said Yamaji.

Apple and Samsung Electronics have retained the top two spots since 2011 while swapping ranks through the years. Huawei struggled to buy chips and dropped down from the No.3 spot to the No. 7 position in 2021. Other Chinese smartphone OEMs, such as BBK Electronics and Xiaomi, significantly increased their semiconductor spending as they successfully compensated for the loss of market share by Huawei in the smartphone market in 2021 (see Table 1).

Table 1. Top 10 Companies by Semiconductor Design TAM, Worldwide, 2021 (Millions of U.S. Dollars)

| 2021 Rank | 2020 Rank | Vendor | 2021 Spending | 2021 Market Share (%) | 2020 Spending | 2020-2021 Growth (%) |

| 1 | 1 | Apple | 68,269 | 11.7 | 54,180 | 26.0 |

| 2 | 2 | Samsung Electronics | 45,775 | 7.8 | 35,622 | 28.5 |

| 3 | 4 | Lenovo | 25,283 | 4.3 | 19,023 | 32.9 |

| 4 | 6 | BBK Electronics | 23,350 | 4.0 | 14,258 | 63.8 |

| 5 | 5 | Dell Technologies | 21,092 | 3.6 | 16,814 | 25.4 |

| 6 | 8 | Xiaomi | 17,251 | 3.0 | 10,254 | 68.2 |

| 7 | 3 | Huawei | 15,382 | 2.6 | 22,710 | -32.3 |

| 8 | 7 | HP Inc. | 13,789 | 2.4 | 10,745 | 28.3 |

| 9 | 9 | Hon Hai Precision | 8,855 | 1.5 | 7,387 | 19.9 |

| 10 | 10 | Hewlett-Packard Enterprise | 6,736 | 1.2 | 5,395 | 24.8 |

| Others (outside top 10) | 337,695 | 57.9 | 269,849 | 25.1 | ||

| Total semiconductor | 583,477 | 100.0 | 466,237 | 25.1 |

TAM = total available market

Source: Gartner (February 2022)

Apple remained at the top of the semiconductor spending customer ranking in 2021. Apple increased its spending on memory by 36.8% and on nonmemory chips by 20.2% in 2021. However, it decreased its demand for computing microprocessing units (MPUs) due to the shift to its own in-house-designed application processors.

Samsung Electronics increased its memory spending by 34.1% and nonmemory chip spending by 23.9% in 2021. The increase of memory spending was the result of not just a rise of memory price, but also Samsung’s growth in its target electronic equipment markets, especially the smartphone and solid-state drive (SSD) markets.

![[데스크칼럼] 삼성 2030 AI 자율 공장 로드맵: 자동화를 넘어 ‘자율 제조’의 시대로 [데스크칼럼] 삼성 2030 AI 자율 공장 로드맵: 자동화를 넘어 ‘자율 제조’의 시대로](https://icnweb.kr/wp-content/uploads/2026/03/Gemini_Generated_Image_2030-AI-factory-1024web.jpg)

![[심층분석] 현대차그룹 ‘모베드 얼라이언스’ 출범… 로보틱스 생태계 확장의 신호탄 [심층분석] 현대차그룹 ‘모베드 얼라이언스’ 출범… 로보틱스 생태계 확장의 신호탄](https://icnweb.kr/wp-content/uploads/2026/03/mobed얼라이너스.jpg)

![[기고] 엔비디아 ‘루빈’의 독주를 멈춰라… AMD·인텔의 ‘실리콘 틈새’ 돌파 전략 [기고] 엔비디아 ‘루빈’의 독주를 멈춰라… AMD·인텔의 ‘실리콘 틈새’ 돌파 전략](https://icnweb.kr/wp-content/uploads/2026/03/NVIDIA-RUBIN-platform-and-whang-1024x545.jpg)

![[공지] 프로피버스/프로피넷 센터 코리아, 2026년 제1회 기술교육 개최… PROFINET 실습 및 심화 과정 강화 [공지] 프로피버스/프로피넷 센터 코리아, 2026년 제1회 기술교육 개최… PROFINET 실습 및 심화 과정 강화](https://icnweb.kr/wp-content/uploads/2026/03/PROFINET-band.png)

![[피플] “생성형 AI 넘어 ‘피지컬 AI’의 시대로… 2026 하노버메세, 제조 혁신의 해법 제시” [피플] “생성형 AI 넘어 ‘피지컬 AI’의 시대로… 2026 하노버메세, 제조 혁신의 해법 제시”](https://icnweb.kr/wp-content/uploads/2026/02/R41_0775-HM26-von-press-900web.png)

![[이슈] 스마트 제조의 방패 ‘IEC 62443’, 글로벌 산업 보안의 표준으로 우뚝 [이슈] 스마트 제조의 방패 ‘IEC 62443’, 글로벌 산업 보안의 표준으로 우뚝](https://icnweb.kr/wp-content/uploads/2025/07/OT-security-at-automotive-by-Gemini-Veo-1024x582.png)

![[그래프] 국회의원 선거 결과 정당별 의석수 (19대-22대) 대한민국 국회의원 선거 결과(정당별 의석 수)](https://icnweb.kr/wp-content/uploads/2025/04/main-image-vote-flo-web-2-324x160.jpg)